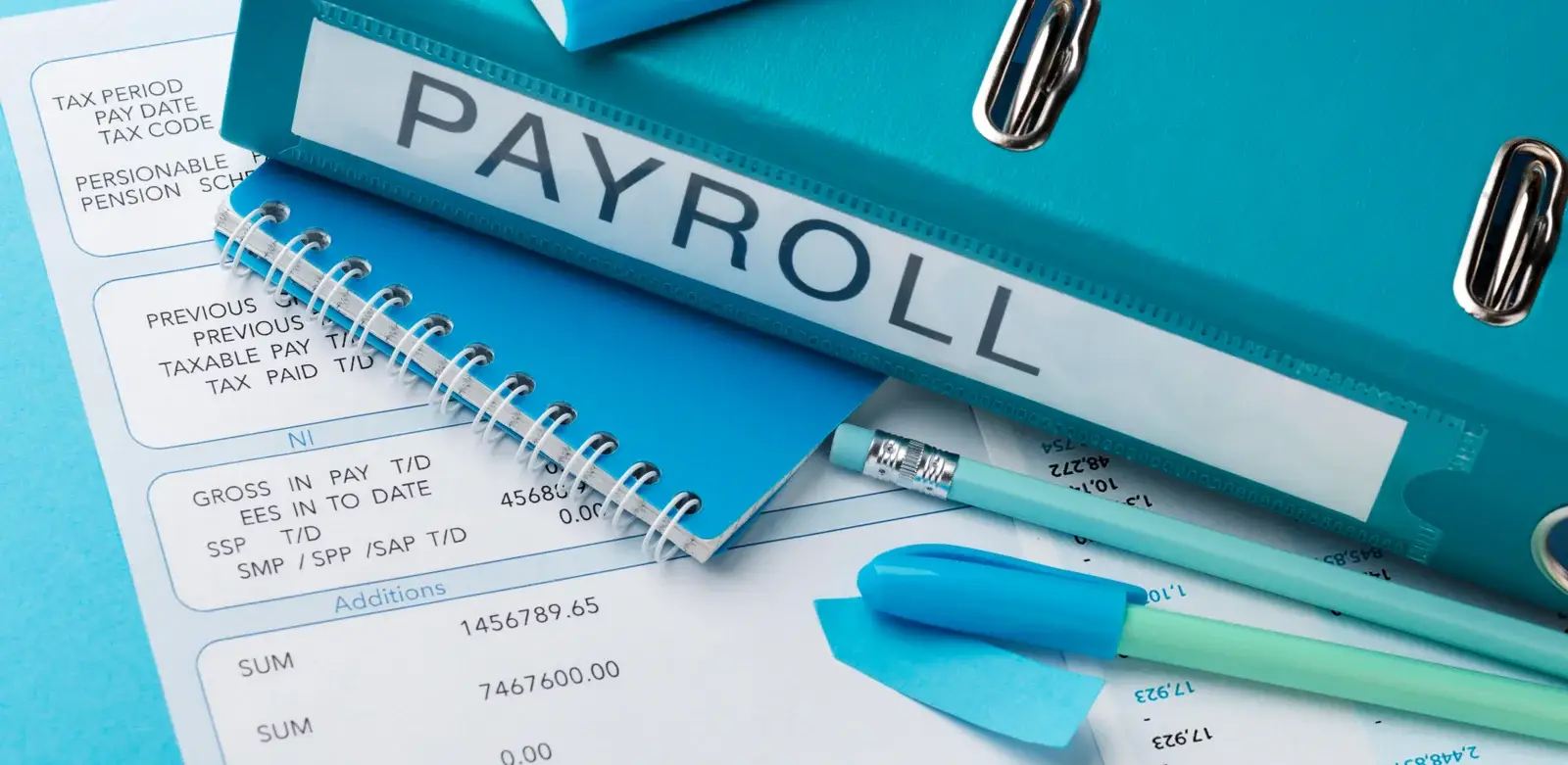

For any business organization, whether small, medium or large managing its payroll is not only time-consuming job in term of manpower but also do not generate any income to the organization. It is virtually impossible for the management to make compliances up-to-date and that to on time as the rules and regulation of various applicable labor welfare laws keep on changing time to time. Therefore, keeping in view the complicity and to get away from this tedious job, outsourcing of payroll management is only solution.

Reduces the need for in-house payroll staff and associated costs, such as software and training.

Ensures adherence to the latest tax laws and regulations, reducing the risk of costly errors and penalties.

Frees up internal resources by handling payroll processing, tax filings, and reporting, allowing employees to focus on core business activities.

Provides advanced security measures and compliance with data protection regulations to safeguard sensitive payroll information.